The "Baby Boom" That Followed World War Ii Contributed to

World War Ii: The Economic Anomaly

For well-nigh 150 years, one of the most important variables in the economic cycle was state of war.

The wheel looked something like this:

- Governments would ramp up spending during wartime.

- This spending would increase wages and earnings, thus leading to prosperity.

- All that spending would somewhen lead to an inflationary spike.

- Prosperity would inevitably be followed past a hangover once that spending dried up when the wars were over.

- A deflationary depression would follow then the cycle would offset all over again with the onset of the next war.

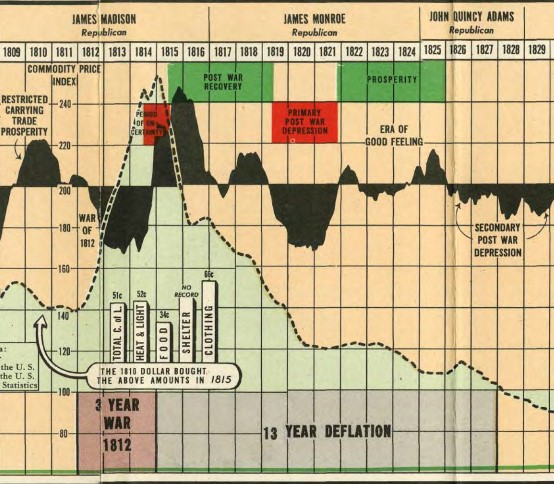

This occurred during the State of war of 1812:

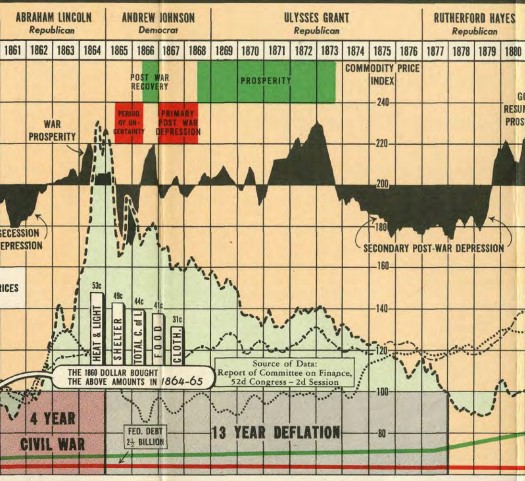

The Ceremonious War:

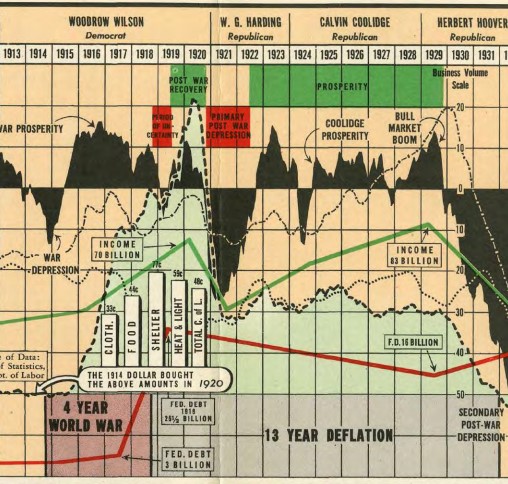

And Globe War I:

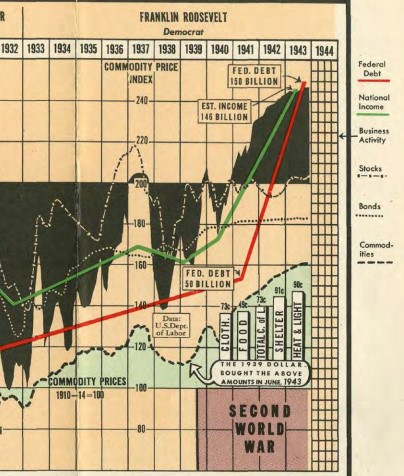

You could basically prepare your clock to information technology. The Earth War Two economical playbook started out the same way:

But the bicycle changed in the backwash of WWII.

We got the war-time prosperity and inflation but never the deflationary depression on the other side. There was a minor recession in 1945 but never a crash that sent the system reeling. WWII is an economical anomaly that inverse the trajectory of the U.s.a. for years to come in terms of growth, jobs, income, demographics and wealth inequality.

This is the story of why that time was different and how Earth War II radically contradistinct the economic landscape for years to come.

*******

Many of the wealthiest business magnates in history were born in the aforementioned decade, proving timing can be everything when it comes to building empires.

Andrew Carnegie (born in 1835), Jay Gould (1836), J. Pierpont Morgan (1837) and John Rockefeller (1839) all built their empires following the postal service-Civil War industrial economical nail. These titans of industry would usher in the Gilded Age, a period of rapid economic growth, technological innovation, and industrialization.

This flow also ushed in a huge influx of the working grade, merely it was mainly a small handful of the upper course that built vast fortunes on the backs of the working class.

The average annual wage of all American workers in the year 1900 was in the range of $400-$500. Andrew Carnegie made 20,000 times that much the very same year.

Following the Panic of 1907 and depression of 1921, the U.Southward. economy would go on a tear different it had ever seen in the roaring 1920s. It was another menstruum of massive technological innovation with the add-on of cars, telephones, movies, radios, and appliances to the consumer landscape.

Unfortunately, past the finish of the decade, most of the gains had once again gone mainly to the wealthy course. Equally the country was merely about to caput into the Bully Low in 1929, Brookings Institution found that just two.iii% of American families had incomes of more $10,000 a twelvemonth. Only 8% made more than $5,000 annually. And more than lxx% of families lived on less than $1,000 a year. They further estimated that nearly lx% of American families had incomes that placed them beneath the poverty line.

If the Golden Historic period prepare off a new era of wealth inequality, the roaring 20s kicked it into overdrive.

When the Great Depression hitting, the stock market crash decimated investors, with stocks falling up of 85% in less than 3 years. When stocks and valuations rise as fast equally they did in a period such as the tardily-1920sane the initial reaction from most people who follow the markets would be that "everyone" must have been invested at the fourth dimension. So when the crash striking, all those noobwhales who jumped in when things were good surely rushed to the exits when things got bad.

But that's just not the case.

At that place were only ane.v 1000000 or then people invested in stocks in 1929 or a piffling more than than 1% of the U.s. population.2 It was mostly the wealthy class who were invested in the stock market at the time just even with the marketplace crash, the Great Low had a far greater affect on the lower-income form.

Here's how Frederick Lewis Allen described this in his book nigh the aftermath of the 1920s:

Among the comparatively well-to-do people of the country (those, allow u.s.a. say, whose pre-Depression incomes had been over $v,000 a year) the great majority were living on a reduced calibration, for salary cuts had been extensive, especially since 1931, and dividends were dwindling. These people were discharging servants, or cut servants' wages to a minimum, or in some cases "letting" a servant stay on without other compensation than board and lodging. In many pretty houses, wives who had never before—in the revealing electric current phrase—"done their own work" were cooking and scrubbing. Husbands were wearing the old suit longer, resigning from the golf guild, deciding, perchance, that this twelvemonth the family couldn't afford to get to the beach for the summertime, paying lxx-5 cents for lunch instead of a dollar at the restaurant or thirty-five instead of fifty at the lunch counter. When those who had flown loftier with the stock market in 1929 looked at the stock-market place page of the newspapers nowadays their only consoling thought (if they yet had any stock left) was that a judicious sale or ii would result in such a capital loss that they need pay no income tax at all this year.

The wealthy class was forced to cut back but most were still relatively wealthy. It was those who lived below the poverty line that had trouble finding work, food, and even shelter.

The New Deal created a series of fiscal programs, reforms, regulations, and relief that stopped the haemorrhage from the Cracking Depression just prosperity didn't return until the massive borrowing and defense spending that went into play for WWII.

Because of the technological innovations that were sweeping the country in the early 20th century, the productivity of American business was already taking off in the pb up to the state of war, even during the dreadful 1930s. Output per hour of work increased past 12% from 1900-1910, 7.five% during the 1910s, 21% during the 1920s and an amazing 41% during the 1930s.

Even with this productivity boom, confidence was still low for almost business leaders as the scars from the Cracking Depression ran deep so most companies still pumped the brakes in terms of operating at or almost full chapters. That all changed once the war started.

New plants sprang upwardly on the double to produce tanks, trucks, weapons, and anything else the U.S. authorities needed for the state of war. Allen explains how this gear up off an unprecedented spending spree:

Now, with the coming of the state of war emergency, the brakes were removed. For the military planners at Washington had conceived their plans on a truly majestic calibration. Past the end of the war the United States had a total of over twelve one thousand thousand men in service, as confronting less than five million in World War I. The devisers of the attempt had resolved that these forces of ours would exist the all-time armed, best equipped, best supplied, and most comfortably circumstanced in history—which they were. And we had to supply non only our ain forces, merely others as well. The consequence, in terms of output and of cost, was astronomical. By the end of 1943 we were spending money at five times the peak charge per unit of Globe State of war I. During the nineteen-thirties, critics of the New Bargain had go apoplectic over annual federal budgets of seven or eight or ix billions, which they felt were carrying the United states of america toward bankruptcy; during the fiscal year 1942 we spent, by contrast, over 34 billions; during 1943, 79 billions; during 1944, 95 billions; during 1945, 98 billions; during 1946, 60 billions. For the final four of these years, in fact, our almanac expenditures were greater than the total national debt which had been a matter of such grave concern during the Depression. That national debt had risen from 19 billions in Hoover'due south concluding yr in office to twoscore billions in 1939—and here was the government, but a few years later, spending upwardly to 98 billions per year, and thus piling the national debt up to 269 billions by 1946! These colossal sums fabricated annihilation in the previous history of the U.s. await like small change.

By 1945, Gdp was 2.iv times the size of the economic system in 1939. Allen called it, "the most extraordinary increase in production that had always been accomplished in five years in all economic history."

Everyone who wanted a job could find work. Consumers spent money like crazy, finally letting go of the frugal spending habits that had been ingrained in them since the Great Depression. Following 1 of the worst economic decades in history along with two globe wars, information technology must accept been a relief for people to spend some money on themselves for a change.

Surprisingly, this economic boom didn't benefit the wealthy class equally much every bit it had in the past. It was the working class who experienced the majority of the gains during the war. The average pay for manufacturing workers was upwardly near 90% between 1939 and 1945, far outpacing the 29% inflation during that fourth dimension. And information technology was people with the lowest incomes who experienced the biggest blindside for their buck.

Here's Allen again:

Who was getting the coin? By and large speaking, the stockholders of the biggest corporations were non getting very much of information technology. These corporations were in many cases getting huge war orders, and thus consolidating their important positions in the national economy; only excess-profits taxes, forth with managerial caution over the uncertainties of the time to come, and with the recollection of the embarrassing scandals of 1918 war profits, combined to keep their dividend payments at modest rates. The stock market place languished. Big capital, as such, was having no heyday.

The master beneficiaries, generally speaking, were farmers; engineers, technicians, and specialists of various sorts whose noesis and ability were especially valuable to the war effort in one manner or another; and skilled workers in war industries—or unskilled workers capable of learning a skilled trade and stepping into the skilled group.

What do these figures hateful in human terms? That millions of families in our industrial cities and towns, and on the farms, have been lifted from poverty or nearly-poverty to a condition where they can savor what has been traditionally considered a middle-class manner of life: decent clothes for all, an opportunity to buy a better motorcar, install an electric refrigerator, provide the housewife with a decently attractive kitchen, go to the dentist, pay insurance premiums, so on indefinitely.

Non merely did the state of war elevator a large swath of the population into the middle class, only it also narrowed the gap between the top and the bottom in terms of wealth inequality. Between the showtime of Earth War I and the end of World War II, the difference in the share of national income between the pinnacle 5% of earners and the lesser 95% narrowed from xxx% to 19.5%. The share of the top one% fell from 13% to vii%. And the dispensable income for all Americans rose most 75% between 1929 and 1950.

Housing got crushed during the Great Low and again the war was the spark to turn things around. Housing starts fell from one million a yr to fewer than 100,000 by the time the damage was done. When people returned from the state of war looking to settle down, housing had a lot of catching up to do.

A federal housing neb, a babe smash, and the huge number of soldiers coming home looking to settle down helped the number of new single-family homes beingness built grow from 114,000 in 1944 to 937,000 by 1946 and a massive 1.vii meg by 1950. Owning a home became the new American dream and basically anyone with a decent job could afford a dwelling house by the 1950s.

Globe War II more or less created the middle class.

And the baby boom that followed, aided past the GI neb which allowed soldiers to buy their first dwelling and get a college didactics, ensured the eye-class way of life had a strong foundation. The economic system went from a focus on military spending to a focus on consumer spending.

Prices and aggrandizement leveled out and there was a two-decade or then menstruum where things were just most perfect for the stock marketplace and the economic system.

After this goldilocks flow of relative economical calm, we've witnessed many of these trends reverse.

Wage growth has slowed for the middle grade considerably. Inequality in America grows by the year as the gap betwixt the haves and the take nots continues to widen. Inflation in the things we want (tech) remains subdued simply inflation in the things we need (healthcare, education, housing prices) has made it hard for many families to become ahead financially.

A number of questions come to listen when thinking through the economic impact of WWII:

- Did WWII interrupt a number of established trends that were already in place?

- Was the growth of the middle class following the state of war an bibelot?

- Is wealth inequality a feature, not a bug, of our backer system?

- Do we need some sort of abnormal shock to the system to narrow the gap between the top and bottom when it comes to wealth inequality?

- Is it possible inflation is by and large a affair of the past if we don't take any more massive wartime spending booms?

I don't know the answers to these questions considering these topics are extremely circuitous. Simply it's worth considering the possibility that WWII changed the economical trajectory of the country.

It'southward also worth considering how many of those changes have now been wrung out of the system.

Sources:

The Big Modify: America Transforms Itself 1900-1950

Since Yesterday: The 1930s in America

The Fifties

Further Reading:

Concern Booms & Depressions: 1775-1943

oneIn a three-and-a-half-year period from the 2nd quarter of 1926 through the 3rd quarter of 1929, the S&P 500 was upwards more than than 200%. That's an annualized return of almost forty% per year.

2One of the biggest reasons that crash was then spectacular is because then many investors who were in the market took on far also much borrowed money to purchase shares. So information technology didn't take much to wipe them out, causing a cascading of selling.

rhodeswhippyraton.blogspot.com

Source: https://awealthofcommonsense.com/2019/10/world-war-ii-the-economic-anomaly/

0 Response to "The "Baby Boom" That Followed World War Ii Contributed to"

Post a Comment